Florida’s legalization debate often gets framed as a culture-war headline, but the biggest question for many residents is simpler: what would adult-use cannabis do to the state’s economy?

Start with the most visible lever—tax receipts. Florida’s Financial Impact Estimating Conference (the state’s official fiscal analysts for ballot measures) projected that, under Florida’s existing tax structure, retail sales of non-medical marijuana would generate at least about $195.6 million per year in combined state and local sales tax revenue, and potentially up to roughly $431.3 million annually, depending on how the market develops.

That “sales tax only” detail matters. The same state analysis also emphasized that Florida does not automatically have a separate cannabis excise tax; creating one would require legislative action. Legalization could produce meaningful revenue even without a special cannabis tax, but lawmakers would control whether to add one—and how to earmark it for priorities like public health, enforcement, or local government support.

Taxes, though, are only the headline number. Adult-use legalization tends to unlock a wider business ecosystem that shows up in jobs, small-business contracting, and commercial real estate. Florida already operates a large medical program, and an adult-use expansion would likely increase demand for cultivation, processing, retail staffing, security, compliance, lab testing, distribution logistics, construction buildouts, and software. Even industries that never touch the plant—marketing agencies, HVAC contractors, electricians, plumbers, insurers, accountants, and software vendors—often gain new clients as the regulated market scales.

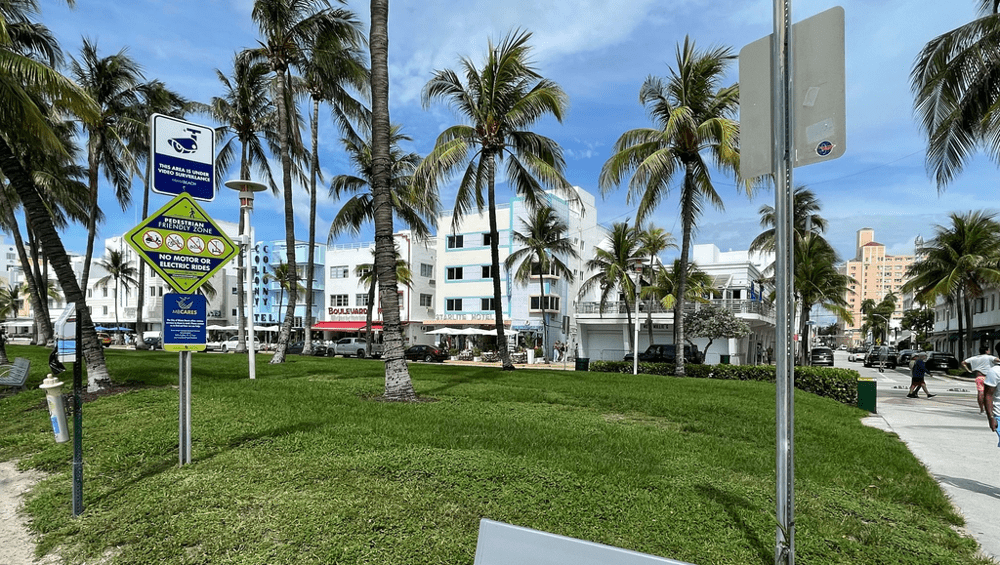

Tourism is where Florida could be uniquely positioned. Visitors already plan trips around beaches, nightlife, theme parks, cruises, and big sporting events. Adding regulated adult-use purchasing could nudge some travelers to extend stays, spend more on restaurants and entertainment, and choose Florida over competing destinations. The spillover isn’t just “people buying cannabis”; it’s hotel nights, rideshares, meals, and local attractions benefiting from incremental discretionary spending.

Market size also matters for investment. Industry data projections have suggested Florida could become one of the nation’s largest adult-use markets, with some estimates placing first-year adult-use sales in the multi-billion-dollar range. When investors believe demand will be durable, they fund greenhouses, manufacturing equipment, store leases, training programs, and product innovation—capital spending that ripples outward to local suppliers and service providers.

To put the potential in context, adult-use states collectively have generated large tax proceeds since the first markets launched in 2014; one industry roundup citing Marijuana Policy Project tallies more than $15 billion in adult-use cannabis tax revenue across states. Florida’s share would depend on its tax design, licensing structure, and how competitive pricing becomes over time.

Local governments would feel the impact, too. New retail corridors can lift commercial occupancy and permit activity, while higher sales volumes can raise local option sales tax collections. Counties could also see workload shifts in code enforcement, permitting, and public safety.

Of course, there are costs and trade-offs. Launching adult use requires rulemaking, enforcement, lab capacity, and public education, and local governments may face zoning and policing adjustments. If prices stay high or access is limited, consumers can remain in the illicit market, reducing the fiscal upside the state is counting on.

The takeaway: legalization wouldn’t be a single revenue stream—it would be a multi-channel economic shift. Even conservative, state-authored estimates point to hundreds of millions in annual sales-tax revenue alone, before you account for job growth, tourism spillover, and new investment that can follow a regulated adult-use market.